Sodium-ion Battery Beginning to Penetrate LIB Market;

Max US$14.2 Bil Market Expected in 2035

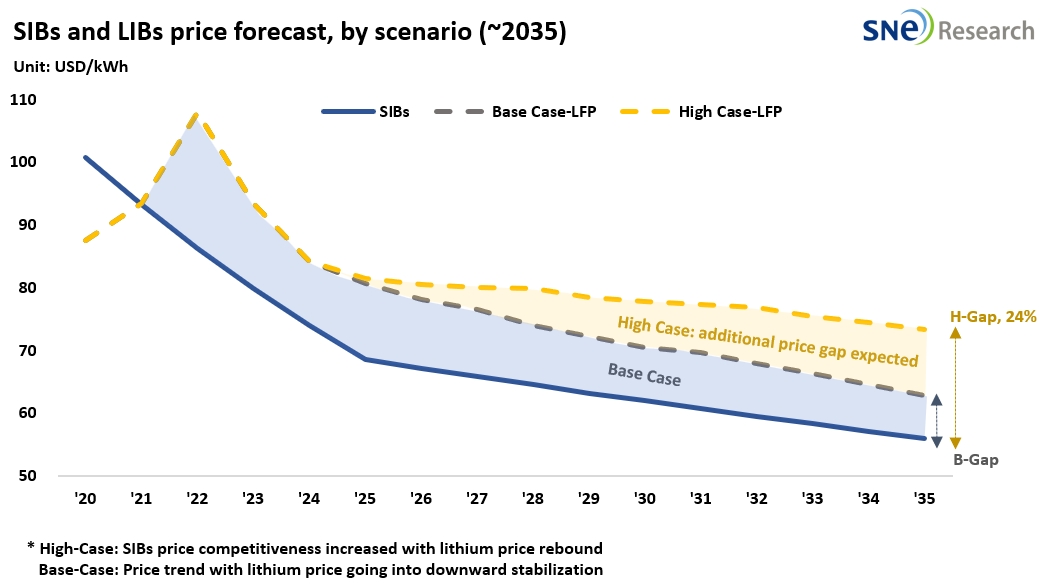

- Sodium-ion battery’s competing model to be low-price LFP battery; SIBs expected to be max. 24% cheaper than LFP

- Taking advantage of its price and stability, SIBs expected to penetrate into electric two-wheelers, small-size EVs, and ESS markets.

Sodium-ion Batteries (SIBs), recently preparing for commercialization, seem to have a potential to penetrate into the low/middle-priced vehicle market, taking advantage of its lower price than that of LFP battery in future.

According to the <2024> SIBs Technology Development Trends and Market Forecast (~2035) report released by SNE Research on Jan 24, 2024, the price gap between SIBs and LIBs (of which cathode is LFP) is forecasted to be max. 24% in 2035. Such a price gap is calculated based on LIBs whose cathode is LFP, known to be cheaper than other LIBs, thereby leading to a reasonable assumption that if SIBs are compared with LIBs with NCM cathode, the price gap is expected to be a lot bigger.

SIBs are next-generation battery that has price competitiveness in the secondary battery market where LIBs have become mainstream. SIBs, using sodium as a raw material, has low energy density, but its electrochemical stability is high and the performance degradation at low temperature is not serious. SIBs are expected to be mass-produced in 2025 and used in the two-wheeler, small-size EV, and ESS industries.

It was the announcement made by CATL in 2021 that triggered the development and advent of SIBs. In its announcement, CATL unveiled its plan to develop and produce SIBs as next-generation battery. In 2022, lithium carbonate, a key material for LIB, was traded at max. RMB 600,000 (approx. USD 84,600 per ton. This led to a spike in the price of LIBs and a lot of attention has gathered to SIBs which use sodium instead lithium.

The price of SIBs is expected to be min 11% / max 24% cheaper than that of LFP battery in 2035. Based on its strong competitive edge in price, SIBs seem to become a new player in the low/middle-priced battery market. According to the analysis by SNE Research, SIBs are forecasted to keep its price competitiveness and be in comparison with LFP LIBs as the battery raw material market would continuously fluctuate. In addition, if SIBs would enjoy more increases in its price competitiveness due to ever-changing raw material prices, SNE Research forecasts that max 254.5 GWh of SIBs demand is expected in the market in 2035. If such demand is converted into price, the market size is expected to 14.2 billion dollar per year.

In China, two-wheelers and EVs using SIBs have been already released in the market. Yadi(雅迪), a presentative electric motorcycle company in China, established its subsidiary Huayu(华宇) and released an electric motorcycle model, ‘Ji Na No.1” (极钠S9)’ in the end of 2023. JAC(江淮汽车), a Chinese EV brand, started to sell Huaxianzi(花仙子), an electric vehicle using the 32140 cylindrical SIB from Hina Battery(中科海纳). The SIBs production capacity by Chinese battery makers is 464 GWh in 2035.

Other than China, Faradion in the UK, Altris in Sweden, Tiamet in France, and Natron Energy in the US have rolled out their plan for mass production of SIBs. On the other hand, in Korea, Energy 11 is the only company to announce the SIB production, while Aekyung Chemical is making anode material for SIBs.